What’s the Difference between Homeowners Insurance and Home Warranty

Owning a home is the one of the greatest investments you’ll make in your life. At the same time, owning a home may also require ongoing and expensive repairs, from repairing a broken appliance to replacing a damaged roof. Depending on what needs to be repaired or replaced – and why – a home insurance policy or a home warranty may help provide protection.

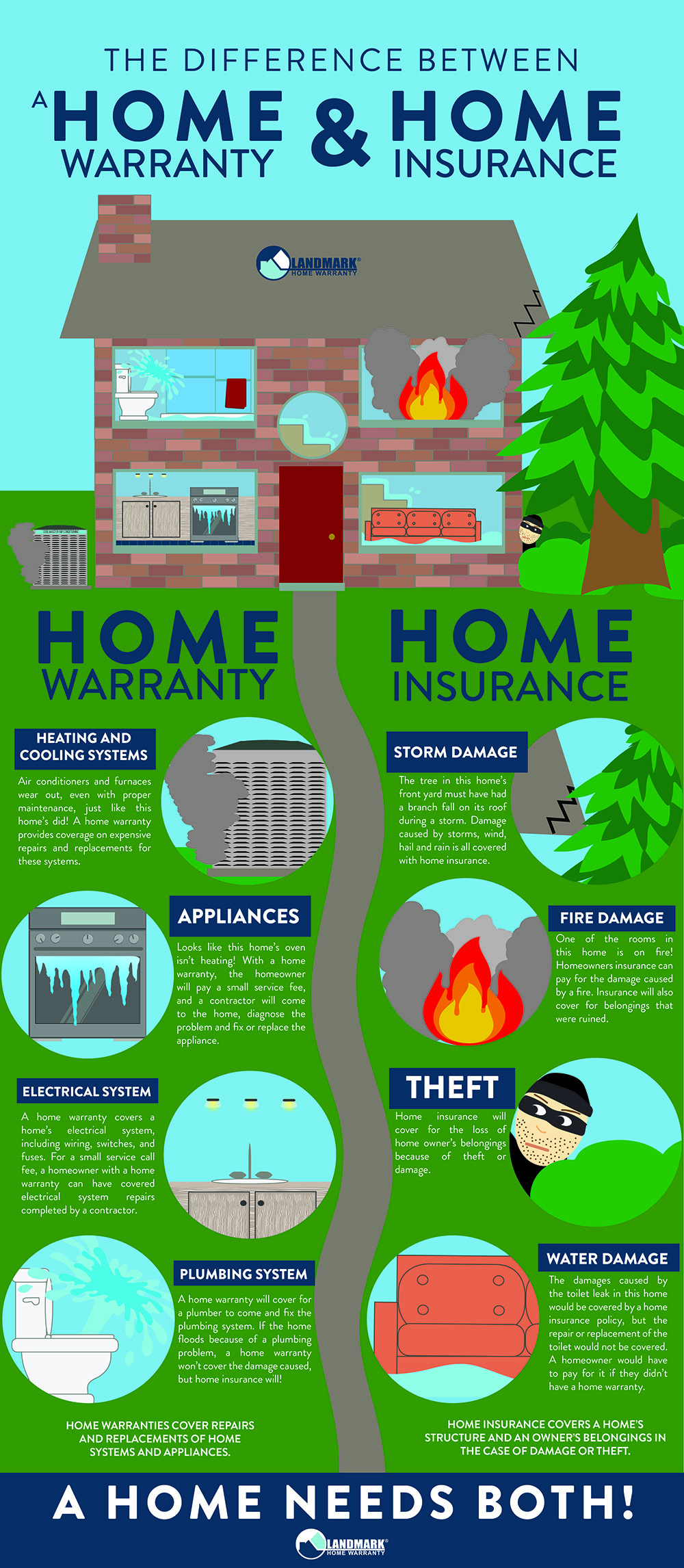

While home warranties and homeowners insurance policies may help cover your home, they don’t offer the same types of protection. Do you need both a home warranty and home insurance, or can you get just one? Let’s take a look at what a home warranty is, what home insurance is, and what the differences are between the two.

What is a home warranty?

A home warranty is a service contract that provides for repair or replacement of your system components and appliances that fail due to age and standard wear and tear. For instance, components of your HVAC, electrical, and plumbing, kitchen appliances and washer/dryer are all typically covered under this warranty. You can also cover larger systems like your pool and spa. Home warranties typically have 12-month contract terms. A home warranty is purely optional but it’s a smart purchase.

How much is home warranty?

A homeowner will pay a yearly premium to their home warranty company, generally between $300-$600.

What does a home warranty cover?

A home warranty covers the main systems in a house, such as a home’s heating, cooling, plumbing, and electrical systems. A home warranty may also cover the larger appliances in a home like the dishwasher, oven, refrigerator, clothes washer, and dryer. Home warranty companies generally have different plans available that provide coverage on all or a select few of these items.

How does home warranty works?

When/if a system or appliance breaks down, instead of calling a repair company, you will call your home warranty company. If the system or appliance is covered under the homeowner’s home warranty plan, the home warranty company will send out a contractor who specializes in the repair of that particular system or appliance. You will pay a flat rate service call fee (usually between $60-$100, depending on the home warranty company) to have the contractor come to your home and diagnose the problem. If the issue has been caused by something covered under the home warranty contract, then the home warranty company will pay for the repair or replacement and all the you have to pay is for the service call fee and yearly premium.

What is homeowners insurance?

A home insurance policy covers any accidental damage to your home and belongings due to theft, storms, fires, and some natural disasters. There are four primary areas covered under the policy: the interior and exterior of your home, personal property in case of theft, loss or damage, and general liability that can arise when a person is injured while on your property. A home insurance policy is usually mandatory, if you have mortgage on your home. All home insurance policies offer a deductible, which is what you’ll pay when a claim is made. A home insurance deductible can be anywhere between $100 to $2,000. Generally, the higher the deductible, the lower the yearly premium cost.

How much is homeowners insurance?

Home insurance policy is renewed yearly. On average, this is somewhere between $300-$1,000 a year, depending on the policy and deductible.

What does a homeowners insurance cover?

Home insurance covers damage to a house’s structure and a homeowner’s personal property from fires, theft, rain, hail, wind, trees, explosions, overflow of water, and other disasters. For example, if a tree falls and crashes into your kitchen, your homeowner’s policy would help you repair and replace your damaged appliances.

How does homeowners insurance works?

When something is damaged by a disaster that is covered under the home insurance policy, you will call the home insurance company to file a claim. An insurance adjuster will come to your home and fill out a claim for repair and replacement of any damaged items in your home. Once the claim is approved, the insurance company will deduct the amount of your deductible and issue you a payment for the rest of balance to repair your home.

Do I need home warranty for new home?/span>

Typically, new home builder provide one year warranty on new construction home. You can buy home warranty for coverage starting from year 2 and most home warranty company will allow that. Keep in mind though, if you decided to get home warranty for new build home, you must get it at the same time when you bought your new home, that way you can will the special introductory pricing.

Conclusion

The main differences between home warranties and home insurance are what they cover. Home insurance will help homeowners to pay for structural damage and loss of personal property from emergencies like theft or fire, while a home warranty covers repairs and replacements of a home’s systems and appliances when they fail from old age and normal wear and tear. A home warranty and home insurance provide protection on different parts of a home, and together they can protect a homeowner’s budget from expensive repairs when they inevitably crop up.

Home Warranty Company in Phoenix area

American Home Shield Home Warranty

Swee Ng, Realtor and Phoenix East Valley resident specializing in win-win real estate transaction through great communication and fighting for his clients’ best interest. After all, this is more than real estates, this is about your life and your dreams.

If you are looking to buy or sell your home in Phoenix AZ and surrounding area, we hope you will consider us. Contact us today for complimentary consultation.

New Listing in Last 24 hour Phoenix AZ

Search and view your dream home your way

Receive email alert as soon as a Gilbert property matching your criteria hits the market. Be one of the first to see new listings. Simply type in everything you want in a house and save your search here to be notified.