What you need to know if you are thinking of buying a house in 2019 in Phoenix AZ

Whether you’re looking to buy or sell a home in 2019, it helps to know what you’re up against. Here are things to expect if you and your family are considering buying house in Phoenix area.

Mortgage rates will go up (again)

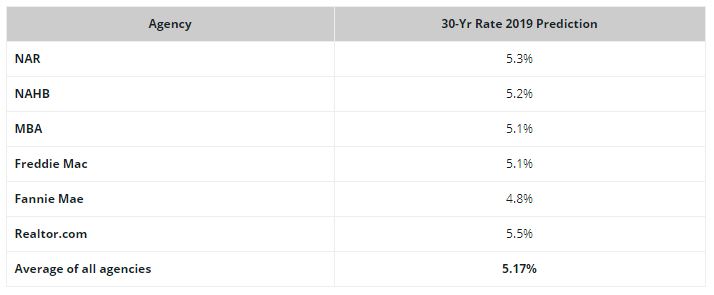

The most important consideration for most buyers when looking to buy a home is how much they can afford. Mortgage rates can be difficult to pin down with precision, but experts agree on one thing: Rates will stay at 5 percent throughout 2019. National Association of Realtors, National Association of Home Builders, Mortgage Bankers Association and other agencies forecasting interest rate will be at 5% range in 2019.

Here are some predictions from the largest housing and mortgage groups for the 30-year fixed-rate mortgage:

– The Mortgage Bankers Association forecasts the average 30-year fixed mortgage will hold at 5.1 percent for most of the year

– Realtor.com has mortgage rates averaging 5.3 percent in the coming year and reaching 5.5 percent by the end of 2019

– The Mortgage Bankers Association anticipates the 30-year fixed-rate mortgage will level out at 5.1 percent

Home price in Phoenix area are raising

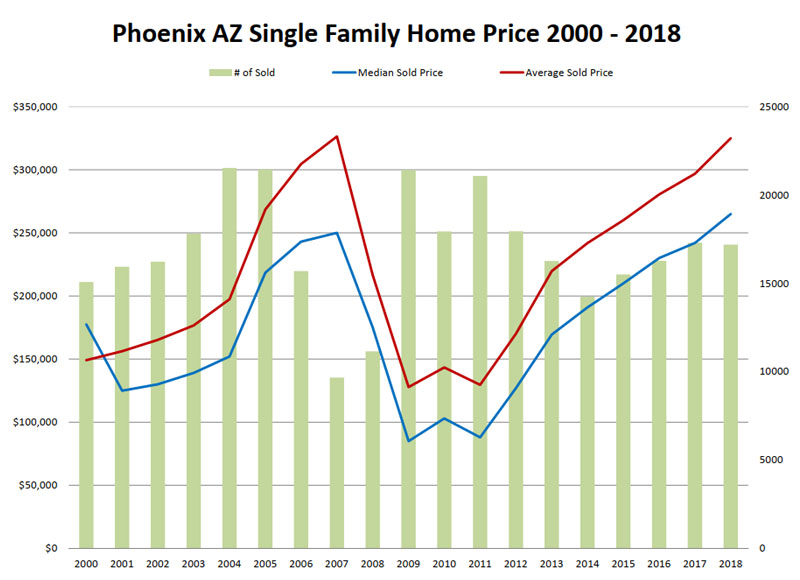

The house value for single family home in Phoenix had been increasing since 2011. Based on 2018 Phoenix Arizona Housing Market Trends Report, home price for single family homes has increased about 10% from a year ago. Median sold price for single family home in 2018 was $264,900 compare to $242,500 in 2017. The median sold price for single family home in Phoenix has increased about 9.2% from 2017. Average sold price for single family home in Phoenix AZ was $324,909, compare to $296,956, in 2017, and that was about 9.4% increased from 2017.

According to Realtor.com, Phoenix’s housing market is set to keep up its healthy pace into 2019. Realtor.com forecasts the region’s market will post sales growth of 3.6 percent this calendar year, along with price growth of 5.6 percent.

Keep an eye on inventory

Lack of housing inventory, especially for entry-level homes, has been a thorn in buyers’ sides since last year. The situation isn’t expected to get much better in the coming year. Inventory had been slightly decreasing from a year ago. In Phoenix, there were 21,282 new listing single family homes for sale in 2018 compare to 21,629 in 2017, that’s about 1.7% decreased from a year ago.

Although we will see more in balance market in some areas, if the house is move in ready and is priced competitively, chances you will see a multiple offers situation bidding war going on too.

Be prepare to pay more

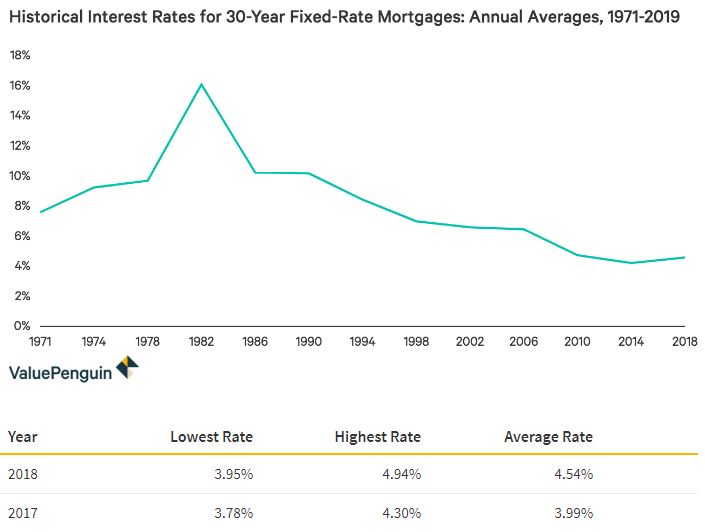

With interest rate is expecting to increase and low inventory, buyer will have to pay more compare to a year ago. The monthly average interest rate rose to 4.54% in 2018, up 0.55% from 2017 3.99%. For buyers who will purchase at the current median sales price of $264,900, that equates to approximately $100 added to their monthly payment compared to last year.

Down Payment Assistance Program still available

Down Payment Assistance Programs such as Home in 5 and Home Plus still available. These down payment assistance program provides a 30 years fixed rate mortgage with a down payment assistance (DPA). These down payment assistance can be used toward the down payment and or closing costs. The DPA is equal to a percentage of the first mortgage and is proved in the form of a three-year, no interest, no payment, deferred soft second mortgage. The DPA is forgiven monthly at a rate of 1/36 over the term of the lien. Basically home buyer with go with DPA program have to keep the mortgage for at least 36 months. If home buyer sell or refinance their home during this 36 months, they will have to pay it back. Keep in mind that these program is not just for first time home buyer.

2019 FHA Loan Limits for Arizona

The new FHA loan limit for one-unit homes in Maricopa county will be $314,827 in 2019, up from $294,515 in 2018. This is great news for Arizona home buyers planning to use the FHA home loan product to buy a home in 2019. As you may know, the FHA loan is one of the most popular home loan. Borrowers can qualify for an FHA loan with a down payment as little as 3.5% and a credit score of 580 or higher.

Wondering how much house you can afford?

Click here to access the Mortgage House Payment Calculator. Simply add in the price of the home you are considering and the calculator will return your estimated house payment. Change length of loan and interest rates to adjust results.

New Listing in Last 24 hour Phoenix AZ

Swee Ng, Realtor and Phoenix East Valley resident specializing in win-win real estate transaction through great communication and fighting for his clients’ best interest. After all, this is more than real estates, this is about your life and your dreams.

If you are looking to buy or sell your home in Phoenix AZ area, we hope you will consider us. Contact us today for complimentary consultation.

Search and view your dream home your way

Receive email alert as soon as a Gilbert property matching your criteria hits the market. Be one of the first to see new listings. Simply type in everything you want in a house and save your search here to be notified.