What you need to know about Property Taxes in Arizona?

One of the expenses of owning a home is property tax. Many homeowner have some confusion on how are Arizona property taxes are calculated. Arizona property taxes on owner-occupied residences are levied based on the Assessed Value. You do not pay your property tax based on the full cash value (FCV) or current market value of your property.

Photo by: Nataliya Vaitkevich on pexels

How are Arizona property taxes assessed?

The total tax rate for your property is comprised of a mix of primary and secondary tax rates that are levied by the various jurisdictions that pertain to your property. The County Assessor’s office establishes a value for all properties as of January 1st of the previous year of your tax bill. In August of the following year, the year of your tax bill, the tax rates are set.

Primary property taxes pay for the operation budget and maintenance of state and local governments. The secondary property taxes fund voter approved items (such as school budget overrides) and special district levies.

View a sample tax bill for more explanation of the various components of your bill.

How do you pay your Arizona property taxes?

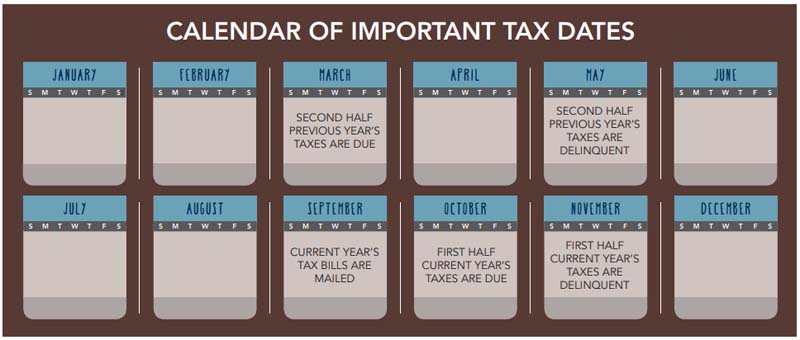

Arizona taxes are paid in arrears and may be paid in two halves. Property tax statements are mailed in September for the current year. The first half of the taxes is due September 1 and delinquent November 1. The second half is due March 1 in the following year and delinquent May 1.

When you receive your bill, you will receive two stubs to use for making your payments. You will not receive a reminder to make your second installment. However, you also have the option of paying your taxes in a single installment – that deadline is December 31st.

What you need to know as homeowner?

Always check the property description on the tax statement to avoid paying on the wrong property. To assure proper posting of payment and information to your property, furnish your parcel number when making any payments or inquiries at the Assessor or Treasure’s office. Your parcel number can be found on the valuation card sent to you by the Assessor each year and is usually in the following format: ###-##-###. Sometimes the number is followed by a capital letter.

Arizona law does not recognize failure to receive a tax statement as a reason for waiving interest. The Treasurer must and will assess interest on all delinquent payments.

Arizona Tax Calendar

January 1st: Current taxes become a lien not yet payable. First day to file exception with the Assessor’s Office.

February 1st: On or before this date, Assessor is required to notify property owners of any increase in taxes or of delinquent taxes for previous years sold at auction. (Three year redemption period)

February 15th: Last day to file an appeal with the Assessor’s Office if the property owner feels that the values are excessive or that they violate the limitations of increase.

February 28th: Last day to file exceptions.

March 1st: Second half taxes for the previous year, are due and payable.

May 1st: Second half taxes for previous year, are now delinquent.

September 15th: Tax statements are mailed mid-September.

October 1st: First half of current year taxes are now due and payable. You may pay for the full year at this time.

November 1st: First half of current year taxes are now delinquent.

For more information, contact the treasurer at (602) 506-8511 or www.treasurer.maricopa.gov.

Trick to remembering tax due dates

Since Arizona property tax is due on two separate date, it may be difficult to remember deadlines. Here is a trick with one simple phrase: “Oh No, More Money!”

Oh, O is for October. October 1st property taxes are due.

No, N is for November. November 1st property taxes are delinquent.

More, M is for March. March 1st property taxes are due.

Money, M is May. May 1st property taxes are delinquent.

Conclusion

As homeowner, if you have a mortgage on your home, you probably don’t think about them too often. The company who services your mortgage typically already setup an escrow account and pay your property tax on behalf of you. However, if you own your home with free and clear title or you did not setup an escrow account with your mortgage company, you will want to make sure you are informed about when taxes are due to make sure you get your payments in on time.

New Listings in Last 24 hour Phoenix AZ

Search and view your dream home your way

Receive email alert as soon as a Phoenix property matching your criteria hits the market. Be one of the first to see new listings. Simply type in everything you want in a house and save your search here to be notified.